The risk of a recession in the U.S. economy looms large as escalating tensions from trade wars and tariff policies cast uncertainty over financial markets. Recent forecasts concerning the U.S. recession indicate that investor confidence is wavering, with the University of Michigan’s consumer sentiment index dropping significantly. As the Federal Reserve wrestles with the decision of whether to adjust interest rates, the potential impacts of tariffs on the economy become increasingly apparent. Economists warn that the ongoing trade war effects could exacerbate economic challenges, leading to slower growth or even contraction. With all eyes on how these factors will unfold, the discussions surrounding the economic outlook have never been more critical.

Concerns regarding the looming threat of economic downturns in the United States are mounting, particularly as recent policy shifts and international trade disputes yield unpredictable outcomes. Predictions surrounding the likelihood of an economic slump suggest that many are re-evaluating their investments amid rising fears linked to tariff impacts. The evolving landscape of the market, coupled with shifts in consumer confidence, presents a complicated picture of the country’s fiscal health. Additionally, the Federal Reserve’s deliberations on maintaining or altering interest rates further complicate the economic climate. With the interplay of international relations and domestic policies at play, understanding the sentiments surrounding these economic fluctuations is vital.

U.S. Economy Recession Risk: Foreboding Signs

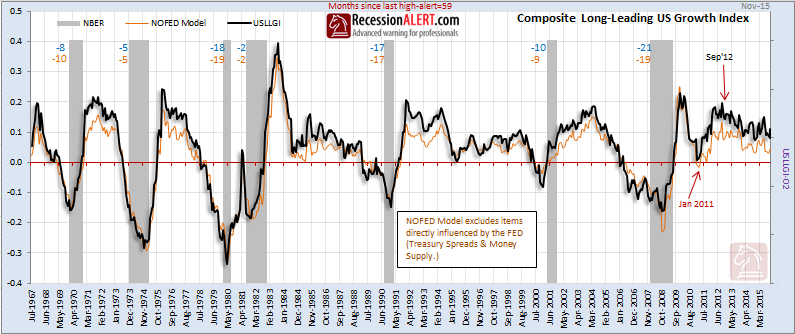

As we navigate through 2025, the prospect of a U.S. economy recession looms larger in the minds of analysts and investors alike. Recent reports indicate significant drops in consumer confidence, as highlighted by the University of Michigan’s consumer sentiment index, which marks its lowest levels since late 2022. The backdrop of a persistent and escalating trade war with major partners like China, Canada, and Mexico adds further to the uncertainty. With tariffs impinging on domestic businesses and raising consumer prices, many fear that these factors will induce a marked slowdown in economic activity.

Moreover, the specter of a recession is compounded by volatility in the stock market and potential fiscal crises stemming from government spending cuts. Economic models suggest that when consumer spending contracts and investment dwindles, the pathway to a recession becomes increasingly plausible. As Jeffrey Frankel outlines, the mix of rising fears about future economic conditions and actual declines in hiring could signal that we are on the cusp of an economic downturn.

Impact of Tariffs on Economy: A Double-Edged Sword

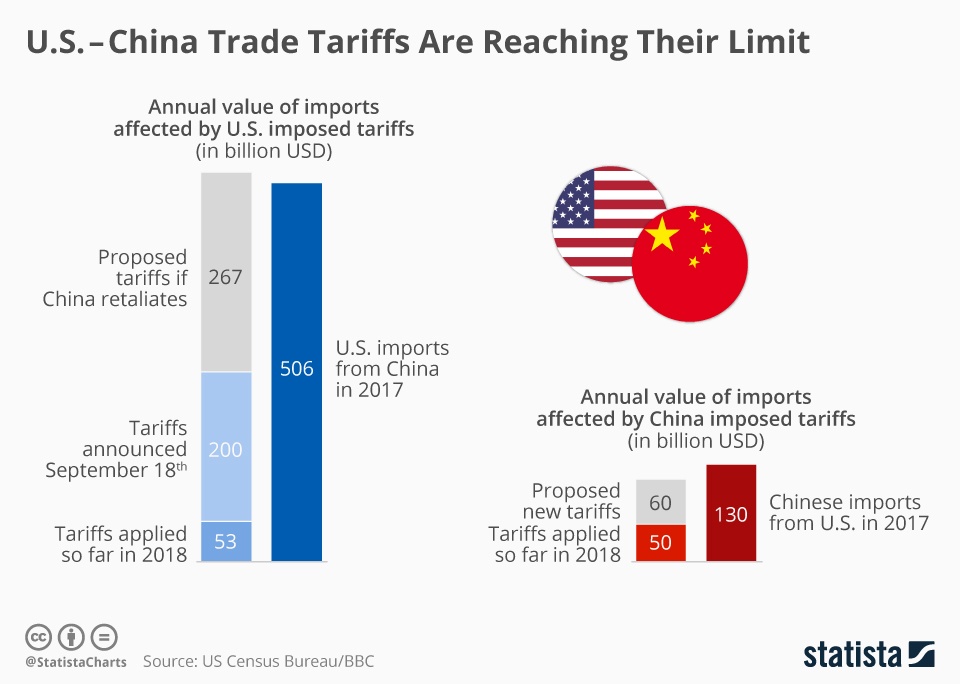

The introduction of tariffs by the current administration is aiming to protect domestic industries; however, it appears to be having the opposite effect on the broader U.S. economy. While some argue that these measures are necessary to boost local manufacturing, evidence suggests that tariffs are dampening investors’ sentiments and creating a climate of uncertainty that could hinder economic growth. The immediate reaction in markets has been one of apprehension, with declines in stock prices signaling investor fears of prolonged trade tensions.

Additionally, economists note that while protecting certain industries may lead to temporary gains, the long-term consequences of tariffs often outweigh these benefits. Increased costs for consumers and a disruption in international supply chains can impede overall economic progress. As the perpetual tug of war between domestic protection and global competition unfolds, the damaging repercussions of tariffs could very well push the U.S. closer to economic stagnation.

Federal Reserve Interest Rates: Walking a Tightrope

The Federal Reserve’s decision on interest rates remains a critical focal point as the economy shows signs of strain. The institution must balance two opposing forces: the need to stimulate economic growth through lower rates against the risk of rising inflation in an already turbulent economic landscape. Recent trends suggest that the complexities introduced by trade wars and changing government policies make these decisions even more challenging.

As the Fed meets to discuss its monetary policy, the dual pressures of supporting employment and containing inflation will be at the forefront. Current economic models indicate that maintaining higher interest rates may help curtail inflationary pressures. However, this approach risks stifling growth and could push the nation closer to the dreaded recessionary threshold. Therefore, the central bank’s next moves will be crucial in determining the near-term outlook for the U.S. economy.

Trade War Effects: A Catalyst for Economic Slowdown

The ongoing trade war has far-reaching implications for the U.S. economy, acting as a catalyst for potential recessive trends. As tariffs heighten the costs for American companies reliant on foreign goods, consumer prices are likely to rise, dampening spending power and overall economic activity. Reports suggest that the uncertainty surrounding trade negotiations is leading to a slowdown in business investment, as many companies adopt a wait-and-see approach instead of making long-term commitments to growth.

Furthermore, the trade war’s impact on international relations complicates future collaborations, potentially leading to retaliation that could exacerbate the economic landscape. The feedback loop of increased tariffs triggering less consumer spending creates a precarious environment where repeated downturns could become the norm, solidifying fears of an impending recession.

Consumer Sentiment Index: A Reflection of Economic Health

The importance of the consumer sentiment index cannot be overstated in understanding the health of the U.S. economy. With recent figures suggesting a decline to their lowest levels since late 2022, this index reflects mounting apprehension among consumers regarding their financial futures and overall economic stability. As consumer sentiment significantly influences spending behavior, a drop in confidence typically signals reduced economic activity, which is concerning for growth projections.

The downward trend in consumer sentiment may correlate closely with the ongoing uncertainties surrounding tariffs and trade policies. When consumers feel insecure about their financial well-being, they tend to curtail discretionary spending, leading to a slowdown in retail sales and, by extension, the economy as a whole. Monitoring shifts in this index will be essential for economists and policymakers alike as indicators suggest that a cautious consumer could further exacerbate the risk of a recession.

Addressing the Risks: How to Navigate Troubled Waters

Given the precarious state of the U.S. economy, stakeholders must develop strategies to navigate the turbulent waters ahead. Economic policies should focus on enhancing stability within key sectors, promoting investment in innovation, and fostering international partnerships that can counterbalance the adverse effects of ongoing trade tensions. Policy measures that provide clarity and direction can help restore consumer confidence, mitigate risks, and stimulate spending.

Additionally, engaging in open dialogues that include multiple perspectives on trade and tariffs is crucial. Rather than relying solely on protective measures, comprehensive approaches to international trade that consider broader economic implications may yield more sustainable outcomes. As we move forward, the intersection of sound policy-making and informed consumer behavior will be pivotal in shaping the near-term economic landscape.

Stock Market Trends: Indicators of Economic Sentiment

The stock market often serves as a barometer of economic confidence, reflecting investors’ expectations regarding future growth. Recent volatility in the market, marked by significant sell-offs, has raised alarm bells for many as the specter of recession looms. Falling stocks can translate to reduced investment and consumer spending, creating a vicious cycle that deepens economic woes.

Investor sentiment is heavily influenced by macroeconomic factors, and the current climate, characterized by trade disputes and uncertainty over the Federal Reserve’s policies, complicates these perceptions. As businesses adjust strategies in response to market fluctuations, the focus must remain on fostering resilience through diversified investment and robust economic planning.

Government Spending Cuts: Potential Consequences

In efforts to manage the national budget, proposed government spending cuts may trigger unintended negative consequences for the U.S. economy. Reducing government expenditure can lead to slower growth rates, increase unemployment, and push the economy further toward recessionary conditions. Many sectors, particularly in infrastructure and public services, rely on government funding to promote stability and growth.

The challenge lies in striking a balance between fiscal responsibility and sustaining economic growth. Cuts must be strategically planned and executed to minimize their impact on vulnerable aspects of the economy. Engaging stakeholders in discussions about sustainable budgeting could create a pathway toward maintaining economic momentum while managing fiscal challenges.

Long-Term Economic Outlook: Preparing for Change

Looking at the long-term economic outlook, it is clear that a proactive approach is necessary to prepare for impending challenges. While short-term volatility may produce significant hardships, a focus on structural reforms, enhancing productivity, and diversifying the economic base could position the U.S. for future growth. By fostering an environment conducive to innovation and entrepreneurship, the country can better withstand economic shocks.

Ultimately, the interplay of various factors, including fiscal policies, trade relations, and consumer sentiment, will dictate the health of the U.S. economy moving forward. Stakeholders must prioritize collaboration across sectors to address and adapt to the lessons learned amid current challenges, ensuring resilience in the face of future uncertainties.

Frequently Asked Questions

What is the current U.S. recession forecast considering recent economic indicators?

The current U.S. recession forecast is concerning due to multiple negative indicators, including a significant drop in the consumer sentiment index, which is the lowest since November 2022. Factors such as ongoing trade wars and stock market volatility have increased fears of a recession occurring within the next year.

How do tariffs impact the U.S. economy and recession risk?

Tariffs generally have an adverse effect on the U.S. economy and can exacerbate recession risk. Current tariff policies have led to retaliatory measures from countries like China and Canada, resulting in market volatility and a decline in consumer confidence, contributing to fears of an impending recession.

What are the trade war effects on the chances of a U.S. recession?

The trade war effects are significant, as they create uncertainty in the market and disrupt trade relationships. This unpredictability can lead to reduced investment and consumer spending, thereby heightening the risk of a recession in the U.S. economy.

How do Federal Reserve interest rates influence U.S. recession risk?

Federal Reserve interest rates play a critical role in influencing U.S. recession risk. If interest rates are kept high to combat inflation, it can stifle economic growth and lead to lower employment, which increases recession probabilities. Conversely, cutting rates might support growth but also risk higher inflation.

How does the consumer sentiment index relate to U.S. recession risk?

The consumer sentiment index is a key indicator of consumer confidence and spending habits. A decline in this index, such as the current low levels seen in 2022, suggests decreased consumer spending, which is a crucial driver of economic growth, thereby raising the risk of a U.S. recession.

| Key Points |

|---|

| U.S. markets faced significant drops due to tariff responses from China, Mexico, and Canada, raising recession fears. |

| Consumer sentiment is at its lowest since November 2022, suggesting a decline in economic confidence. |

| Economist Jeffrey Frankel identifies five factors increasing the recession risk: trade war, stock market crash, government spending cuts, potential fiscal crises, and rising risk perceptions. |

| Uncertainty in economic policy has led businesses to adopt a wait-and-see approach, potentially hindering employment and income. |

| The Federal Reserve faces a dilemma with interest rates: cut to support the economy or maintain rates to control inflation. |

Summary

The U.S. economy recession risk is becoming increasingly pronounced as recent data indicates falling consumer confidence and significant market volatility. The combination of escalating trade tensions and uncertain economic policies has created an environment where recession fears are likely to materialize. Analysts are urging caution, as the interplay of these factors suggests that the potential for economic downturns is rising more than ever. The upcoming months will be critical in determining whether the U.S. can navigate these challenges or face a recession.